How good is betting on a South Asian startup incubator dojo aimed at would-be-entrepreneur females with only a burning passion for their crafts and launched in the smack middle of the gloomy pandemic?

Standard Chartered Sri Lanka has announced the appointment of Anuk De Silva as the Head of Corporate Affairs, Brand & Marketing, effective 19 March 2020.

The Commercial Bank of Ceylon has given fresh expression to its commitment to Small & Medium Enterprises (SMEs) with the launch of an exclusive Credit Card for the sector.

Sampath Bank PLC recently announced that its asset base has surpassed Rs. 1 trillion, making it the youngest bank in Sri Lanka to achieve this feat.

Non-Banking Financial Institutions (NBFI) sector has evolved over the past years to be a stronger force in the finance industry in Sri Lanka.

![]()

Iconic Developments recently signed a Memorandum of Understanding (MoU) with leading bank NDB to widen the scope of financing options for prospective homeowners of the latest luxury living space, the “Iconic Galaxy” on Buthgamuwa Road, Rajagiriya.

Softlogic Finance PLC, a subsidiary of Softlogic Capital PLC has announced a capital infusion of Rs. 1.9 Billion by way of a Rights Issue.

With the appointment of the new cabinet of ministers bringing about, a re-start to Sri Lanka’s economic activities, the Colombo Stock Brokers Association (CSBA) extends its wholehearted congratulations and best wishes to the new government, Hon. Prime Minister Mahinda Rajapaksa, and newly-appointed State Minister Hon. Ajith Nivard Cabraal for Finance, Capital Markets, and State Enterprise Reforms.

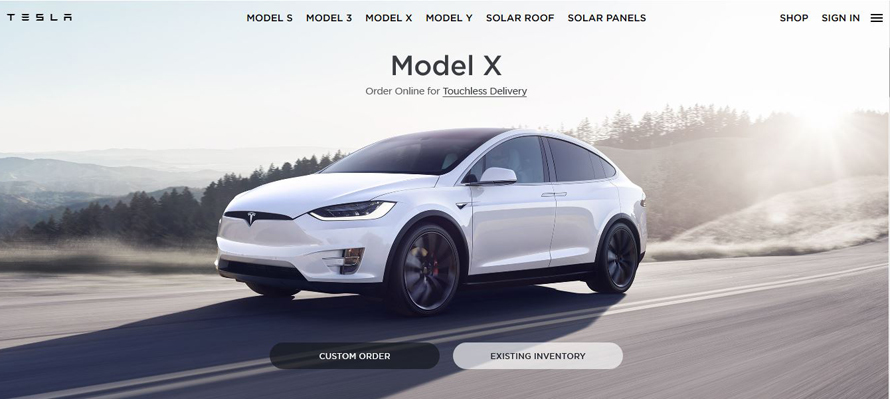

Data presented by Buy Shares indicates that Tesla accounted for 81.66% of all-electric vehicles sold in the United States as of H1 2020.

SampathCards joined hands with Uber and Uber Eats to offer Cardholders ‘Cash Back’ rewards on payments made on Uber and Uber Eats using their Sampath Mastercard Corporate Credit Card.

The Commercial Bank of Ceylon Group has reported mixed results for the first half of 2020, with robust top line growth negated by a combination of factors including pressure on interest margins due to reduced credit demand and interest concessions granted as pandemic relief to borrowers, increasing impairment provisions and low yields on surplus liquidity.